You are here: > About Us > Telkom Management > Remuneration Report

-

Remuneration Report

Dear shareholder,

This remuneration report is intended to provide an overview and understanding of the company's remuneration principles and policies, with a specific emphasis on non-executive directors, executive directors, the executive committee and prescribed officers in the company.The remuneration committee remains mindful of the remuneration trends in the global environment, carefully considers all practices against the business, and sets remuneration levels within the context of overall company performance. The remuneration committee is aware of its responsibility to protect and promote shareholders’ interests in setting executive remuneration and is accountable for the structure and quantum of remuneration.

Susan (Santie) Botha

Chairman of the remuneration committeeThe company has adopted the governance and disclosure requirements stipulated in the King Code of Governance Principles for South Africa, 2009 (King III) and incorporated the required information in this report.

Introduction

This report sets out the company’s remuneration principles and policy for executive and nonexecutive directors and executive management, and provides details of their remuneration and share interests for the financial year ended 31 March 2017.

Role of the remuneration committee and terms of reference

The remuneration committee (remco) acts on behalf of the board in setting the remuneration policy of the group as a whole. It oversees total remuneration for executive directors and senior executives, monitors the execution of the remuneration policy for the organisation as a whole, including non-executives, and makes recommendations to the board.

The committee is responsible for:

• determining the remuneration policy for all employees, including the remuneration of executive directors and senior executives

• determining the total individual remuneration package of each of the executive directors including guaranteed package, benefits in kind, short-term incentive payments and share options. This includes undertaking an annual review, through performance appraisals conducted by the GCEO, of the performance of senior executives and reviewing their guaranteed packages based on the extent to which senior executives have met their performance targets, goals and objectives, as well as approving the annual guaranteed package increases for all other management and bargaining unit employees

• determining targets for performance-related incentive schemes implemented in the company

• seeking board and shareholder approval for any long-term incentive scheme and determining annual grants and share allocations to executive directors and senior executives

• annually reviewing the terms and conditions upon which the executive directors are employed and remunerated

• ensuring that contractual terms on termination and any payments made to executives are fair to both the individual and the company

• reviewing succession plans of executive directors and senior executives and ensuring a total company succession process is in place

• seeking board and shareholder approval for any substantial changes in the remuneration policy

• ensuring regular dialogue with shareholders, to create and maintain a mutual understanding of the meaning of performance and value creation, in order to properly evaluate the remuneration policy

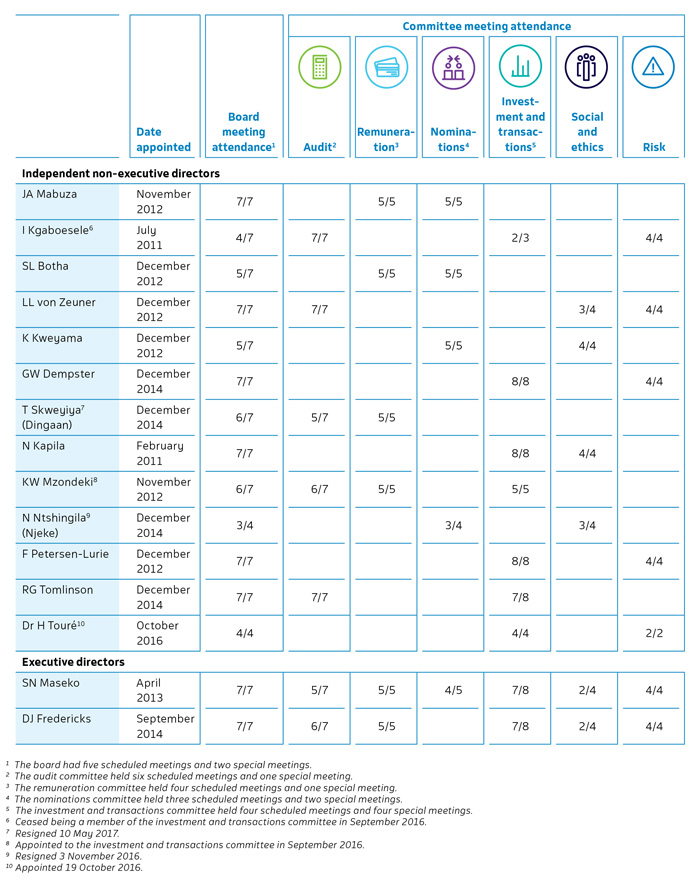

-

Remco composition

The remco is comprises of non-executive directors, all of whom are independent, including the chairman. Executives attending Remco meetings do so in an ex-officio capacity and attend by invitation as provided for in the committee’s terms of reference.

A quorum for a meeting is a majority of members. The following executives attend by invitation:

• SN Maseko (GCEO)

• IM Russell (chief administration officer) replaced by M Lekota (chief human resources officer)

• DJ Fredericks (group chief financial officer)

• JC Smit (group executive: total remuneration and performance management)

-

This report is divided into two sections:

Section 01 provides an overview of the company’s remuneration principles and policies for executive and non executive directors, prescribed officers, and the exco members

Section 02 discloses actual payments, accruals and awards for the year ended 31 March 2017

Section One:

Remuneration philosophy and policy

To ensure we remunerate employees competitively, we use market and industry benchmarks. The benchmarking is conducted to determine appropriate market positioning offerings, which are higher than the minimum prescribed wages. In addition, Telkom recognises "equal pay for work of equal economic value", and strives to remunerate employees doing the same work or substantially the same work, in the same range in accordance with the Labour Relations Act.

The Telkom remuneration strategy is designed to attract, motivate and retain high-calibre talent in a challenging business environment, and supports the delivery of our strategy in a sustainable manner without encouraging undue risks. As the market expands with operators in all spheres of our business and the new operating model, it is increasingly challenging to retain experienced executive leadership, and to attract new talent required for the new and growing areas of our business. Meeting this challenge requires having a competitive and attractive remuneration offering.

We embarked on a turnaround strategy where the current focus is on creating a platform for growth.

To ensure we remunerate employees competitively, we use market and industry benchmarks. Industry and market-related benchmarking is conducted to determine appropriate market positioning offerings which are higher than the minimum prescribed wages. In addition, Telkom recognises “equal pay for work of equal economic value”, and strives to remunerate employees doing the same work or substantially the same work, within the same range in accordance with the Labour Relations Act. However, Telkom recognises that there could be differences which are attributed to the following:

• individuals' respective seniority or length of service

• individuals' respective qualifications, ability, competence or potential above required levels of performance for the job

• individuals' performance – all employees are equally subject to Telkom’s performance management system

• demotion of individual due to restructuring without a concomitant reduction in remuneration

• individuals' lack of relevant skill for a particular job level

• any other differentiator provided that it is not discriminatory

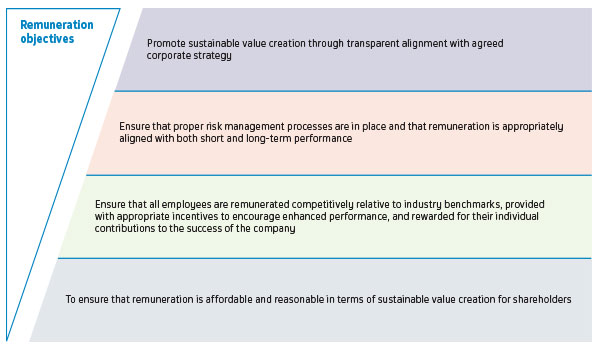

Remuneration objectives

The remuneration policy is designed to attract talent in a competitive labour market and enable Telkom to achieve the following objectives:

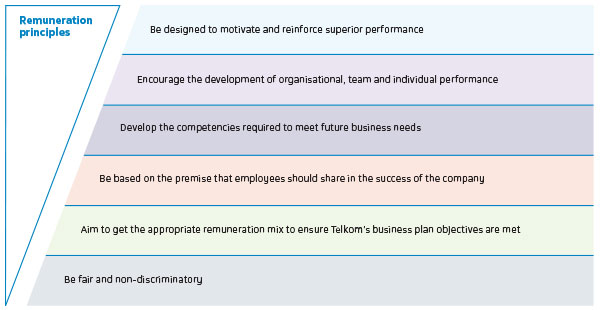

Remuneration principles

Telkom recognises that, in this competitive environment, we need to differentiate based on strategic roles and growing areas of the business to value employees’ contribution. Therefore, our remuneration and reward policies and practices must be based on the following principles:

-

Remuneration structure

The remuneration structure is aligned with the group strategy and the agreed risk appetite, which seeks to reward success fairly, responsibly and transparently, while avoiding paying more than is necessary. The objectives of the policy are:

• to promote sustainable value creation through transparent alignment with agreed corporate strategy

• to ensure that proper risk management processes are in place and that remuneration is appropriately aligned with both short and long-term performance

• to ensure that all employees are remunerated competitively relative to industry benchmarks, provided with appropriate incentives to encourage enhanced performance, and rewarded for their individual contributions to the success of the company

• to ensure that remuneration is affordable and reasonable in terms of sustainable value creation for shareholders

We follow a holistic, balanced approach across the following remuneration elements:

Elements Type Participants and composition of pay Desired outcome Guaranteed package Fixed All employees Guaranteed packages consist of a basic pensionable salary, retirement provision and flexible benefits, which include a non-pensionable allowance and a travel allowance where applicable. Influenced by the scope of the role and the knowledge, skills and experience required. Salary levels are positioned at a market median. Short-term incentives (STIs) Variable All employees STIs comprise a cash payment that is payable after finalisation of audited results. The STI plan is designed and aligned with the shareholders’ expectations. Delivers rewards on the achievement of annual performance targets. The level of achievement determines the level of payment against each weighted company performance measure. Long-term incentives (LTIs) Variable All employees > LTI plan

• senior leadership, M3 to M0 employees

> Employee share ownership plan (ESOP)

• middle management and bargaining unit employees, A to M4/S4Motivate long-term sustainable stretch performance and align the interests of management with those of shareholders. Guaranteed packages

Guaranteed packages The guaranteed packages consist of a basic pensionable salary, retirement provision and flexible benefits Basic pensionable salary

> company contributions to retirement

> other flexible benefits:

• travel allowance

• non-pensionable allowance

• medical aid

• housing allowance

• management provident fundGuaranteed packages are influenced by the scope of the role and the knowledge, skills and experience required of the position holder. The packages reflect the market median which is determined through external market research that yields market data and appropriate salary ranges for specific positions.

Employees are not entitled to annual guaranteed package increases. Annual increases are subject to industry market conditions, employee performance, internal equity, strategic investments and the company’s overall financial position, financial performance and ability to pay. The packages are reviewed against individual performance, set against a market median, and determined on a total cost-to-company basis.

Employees can structure their packages within the framework of the applicable policies, practices and regulatory requirements. Remuneration adjustments outside the annual remuneration review process may be considered in exceptional circumstances and will be subject to the agreed authorisation.

All positions are evaluated to determine their relative value and contribution in terms of complexity and required outcomes. Positions are evaluated using the company’s job evaluation system, which correlates with the Paterson Grading System as follows:

Hierarchical level Level of leadership Telkom grade Group chief executive officer Executive committee M0 Chief officers Executive management M1 Managing directors/group/ managing executives Executive management M2 Executives Executive leadership M3 Senior manager/Manager Frontline leadership M4/M5 Operations manager/Supervisor Frontline leadership M6 Support staff/Technician/Specialist Operational OP1/2/A Exco

Guaranteed packages are in line with similar roles in the comparable market according to organisational size, profitability and complexity. They are influenced by the scope of the role and knowledge, skills and experience required of the employee. Guaranteed packages are reviewed against individual performance, and set against market median. The average guaranteed package increase was 0 percent (FY2016: 6 percent).

Management employees

Guaranteed packages for management levels are reviewed annually as part of the company’s overall remuneration review process and are assessed against individual performance. The average guaranteed package increase was 0 percent (FY2016: 6 percent).

Bargaining unit employees

Telkom follows a balanced approach in granting annual salary increases for bargaining unit employees with due consideration of the Consumer Price Index (CPI), market movements and affordability. The company entered into a two-year collaboration partnership agreement with organised labour in June 2016. The agreement will expire on 31 March 2018. As part of this agreement, no fixed salary increases were implemented for FY2017 and a 6 percent salary increase for FY2018 based on market functional areas’ 50th percentile will be implemented.

Telkom introduced a variable-based incentive scheme for bargaining unit employees, known as Performance Pays. Performance Pays focuses on customer satisfaction and productivity metrics, and replaces the current STI scheme, which is primarily driven by group financial performance. This empowers and enables bargaining unit employees to be more in control of their own destiny and rewards, and gives more direct and clear linkage between individuals’ efforts and their monthly pay.

The Performance Pays incentives vary between 0 percent and 9 percent based on individual performance and are payable per quarter. In addition, employees who perform at or above a three performance rating each year, will each receive a ‘14th cheque’, payable in June 2017. This 14th cheque will be calculated based on individual total package value subject to the company meeting its financial performance targets.

Benchmarking

Executive compensation is benchmarked to data provided in national executive compensation surveys, and information disclosed in the annual reports of companies listed on the JSE.

Ensuring an appropriate peer group to retain the integrity and appropriateness of the benchmark data is a key task of the remco. Executive pay is benchmarked annually.

-

Performance management Introduction

Telkom introduced a variable-based incentive scheme for bargaining unit employees, known as Performance Pays. Performance Pays focuses on customer satisfaction and productivity metrics, and replaces the current STI scheme, which is primarily driven by group financial performance.

Telkom embarked on a performance management initiative in order to review the system and processes.

The focus is on defining key performance indicators (KPIs) for the GCEO, MDs and their direct reports, as well as the frontline staff. The purpose of the initiative is to implement a high-performance management culture that is outcome-oriented, consistent, simple and practical.

A monthly/weekly dashboard will be used to manage the business units and the focus will be on five to 10 critical and consistent KPIs (based on priorities which may change throughout the year).

Overall performance management process Clear process definition Compliance Rewards and consequences Calendar Checks Reviews and coaching Stakeholders Reminders and follow-up Financial impact Decision rights Implications of non-compliance Promotions Transparency on bonus ranges, calibration and bonus pool Principles for KPI design and cascading include:

• Strategic - KPIs (flight plan) must be aligned with group strategy and financial objectives, and must contain a mix of customer, financial, operational and people metrics

• Focused - Metrics per individual are limited to between four and six KPIs (spread across categories). There should be at least one or two relevant shared/team KPIs (for example, consumer EBITDA)

• Practical - Employees must be able to directly influence their KPIs (other than group/BU KPIs). New KPI system was implemented from 1 June 2016

GCEO

The GCEO is rewarded on the delivery of the strategic and operational objectives in line with shareholder expectations and business strategy. The remuneration strategy for the GCEO is designed to align remuneration with long-term shareholder growth and sustainable profitability. The reward should demonstrate the critical and pivotal role the GCEO plays in the achievement of the company’s strategic objectives and operational goals. The following key performance areas were contracted with the GCEO:

Weighting Category Key metrics 40% Financial > EBITDA (total company)

> headline earnings per share (HEPS)

> return on assets (ROA)25% Executing key strategic

milestones> define and implement journey of independence company structure and operating model

> implement strategic shareholder model

• fit-for-purpose strategic shareholder centre

• bias to give business units full autonomy and as much control as possible20% Customer experience > NPS 15% People goals (leadership

and employees)> workforce transformation

> culture shaping and change management

> talent management

• elite leadership development

• accelerated development

• emerging talent development

• career planning and developmentGCFO

The following key performance areas were contracted with the GCFO:

Weighting Category Key metrics 40% Financial > net revenue

> EBITDA margin

> capital expenditure to revenue

> net debt to EBITDA25% Executing key strategic

milestones> capital investment

> cash and liquidity

> financial framework

> stakeholder relationship20% Customer experience > NPS 15% People goals (leadership

and employees)> workforce transformation

> culture shaping and change management

> talent managementSTIs

The STI component is an incentive that rewards the achievement of annual performance targets for management employees.The level of achievement determines the level of payment against each weighted company performance measure. The STI plan is designed and aligned with shareholder expectations.

It emphasises a remuneration policy that is performance driven, supports alignment between senior management and shareholders, and links STI to company performance.

The FY2017 plan was approved by remco and the board, with the following clearly defined principles:

• Both EBITDA and Profit after tax (PAT) targets must be achieved at the group company level to trigger any STI payment.

• No STI will be payable if the achievement is less than the hurdle rate.

STIs STIs comprise cash payment that is payable after finalisation of audited results

> Hurdle rate to qualify for any STI payment is 95%

> Budget target – 100%

> Stretch target – 110%

> Maximum cap – 120%

> Base payment set at 7.4% of PATBargaining unit employees, employees who perform at or above a three performance rating received a 14th cheque. Telkom introduced a 25 percent interim STI payment for all management employees based on the achievement of interim EBITDA and PAT targets.

The size of the STI pool will depend on the achievement of PAT measures and will be variable. In line with the remuneration policy, the overall company performance will be measured at company, business unit and divisional level as indicated below.

Business unit Corporate centre Total Group financials 20% 20% 20% Business unit/ corporate centre 60% 60% 80% Divisional 20% 20% 80% Total 100% 100% 100% The rules, targets and measurements are tabled annually on the recommendation of remco to the board for approval, subject to the actual audited company performance reflected in the plan under review.

STIs plan awarded for FY2017

In accordance with the approved company STI plan, STIs were allocated to business units based on their actual achievement and divisional performance. Individual performance is recognised in the respective business units based on the achievement of individual performance contracts. FY2017 STI targets and achievements (excluding BCX and Trudon) are shown below:

Interim results

Performance criteria Plan weighting % Interim target

FY2017*

RmActual FY2017*

achievement

RmPercent

achievement

(%)PAT 50 1 428 1 923 134.7% EBITDA 50 4 615 5 311 115.1% Final annual results

Performance criteria Plan weighting % Baseline FY2016

RmTarget FY2017

RmActual FY2017*

achievementPercent

achievement

(%)PAT 50 2 306 2 117 3 224 152.3 EBITDA 50 8 424 8 344 9 005 107.9 *The target and achievements exclude the results of BCX and Trudon

-

LTIs

Telkom’s share incentive plans are structured to optimise the company’s overall position, while providing benefits that will assist the company to attract, retain and incentivise executives and top talented employees.

The plan is designed to support the principle of alignment between management and shareholder interests, with the ultimate aim of ensuring growth in shareholder value. The objectives are to motivate long-term sustainable performance, align the interests of top management with those of shareholders, and retain business-critical and top talented employees. In terms of the forfeitable share plan (FSP), a free transfer of shares is awarded to employees, under the condition of forfeiture in the case of termination of service before the vesting/release date; and achievement of the company’s pre-determined performance levels.

From the grant date, the employee has shareholder rights in respect of the forfeitable shares to receive dividend rights and voting rights. The Telkom LTI plan is an FSP, which has two components:

• LTI plan component (senior leadership, M3 to M0)

• ESOP component (middle management and bargaining unit, A to M/S4)

LTI Long-term incentives

> LTI Plan

> ESOPLTI plan component

(M3 – M0)ESOP

(A – M4) -

Vesting of awards

The performance conditions are measured after three years and the number of shares to vest is based on the extent to which the performance conditions are met.

Vesting period: LTI Plan Award (M3 - M0) FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 Total FY2013 50% 30% 20% 100% FY2014 50% 30% 20% 100% FY2015 50% 30% 20% 100% FY2016 50% 30% 20% 100% Total 50% 80% 100% 100% 50% 20% Vesting period: ESOP Award (A - M4) FY2016 FY2017 FY2018 FY2019 Total FY2013 100% 100% FY2014 100% 100% FY2015 100% 100% FY2016 100% 100% Total 100% 100% 100% 100% The following performance condition was set for the vesting of the FY2017 share awards, which were awarded in June 2016:

> Participants in the ESOP will only by measured on operational targets on which they have a direct influence.

Category Performance

conditionWeight F2017 F2018 F2019 F2020 F2021 Financial

70%Total

shareholder

return (TSR)20% Risk free*

+4%Risk free*

+4%Risk free*

+4%Risk free*

+4%Risk free*

+4%HEPS 30% As per the business plan Free cash flow

(FCF)10% As per the business plan Return on

invested capital10% As per the business plan Operational

30%Customer first 15% 62.1% 63.8% 65.2% 66.6% 66.6% Customer Loyalty

Measure (CLM)

– Telkom overall quality

(Revenue weighted

composite score)Baseline 58.6(FY2015) TSA 100 Index 15% Composite

score: 1Composite

score: 1Composite

score: 1Composite

score: 1Composite

score: 1Assurance Index Fulfilment Index Threshold:

0.90Threshold:

0.90Threshold:

0.90Threshold:

0.90Threshold:

0.90* Risk-free rate: Government bond (R203) with a three-year term to maturity to correspond with term of vesting.

A risk-free rate of 7.34 percent plus 4 percent equates to a CPI plus 5.74 percent (real return) -

Total number of shares issued up to 31 March 2017

Year awarded FY2014 FY2015 FY2016 FY2017 Date awarded November 2013 April 2015 June 2015 June 2016 Total number of shares available 26 039 195 19 479 905 14 794 171 10 061 728 Shares awarded 6 559 290 4 685 734 4 732 443 4 886 209 Remaining shares available for future allocations 19 479 905 14 794 171 10 061 728 5 175 519 Total number of shares may fluctuate annually based on forfeiture of shares due to non-performance and resignations, and vesting of shares due to the achievement of performance conditions and pro-rata vesting for good leavers.

Vesting of 2013 forfeitable shares

In accordance with the Telkom FSP, the following shares vested in 2016 based on the achievement of the following performance vesting condition:

> Additional shares award (ASA) for exco members 100 percent if a share price of R50 is achieved after the three-year performance period – the full award vested based on the actual achievement of the performance condition:

Vesting of 2013 forfeitable shares – Performance conditions achieved

ASA award price ASA target price Share price as at 31 March 2016 R23.80 R50.00 R57.57 > LTI Plan (M0 to M3 level management employees):

50 percent of the shares vested in 2016 subject to the extent that the TSR was met over the three-year performance period:

Year TSR target TSR achievement Percent achieved March 2014 RFR (6 percent) +6 percent on a share price of R27.30 (19/11/2013) R33.65 23% March 2015 RFR (6 percent) +6 percent on a share price of R27.30 (19/11/2013) R80.00 193% March 2016 RFR (6 percent) +6 percent on a share price of R27.30 (19/11/2013) R57.57 + R2.45 dividend declaration 120% The full 50 percent forfeitable shares vested for qualifying employees.

> ESOP (M4 – A level employees):

100 percent of forfeitable shares will vest in year three based on achievements of NPS - customer index -

Employment contracts

Employment contracts exist which require three months’ notice of termination by the employee and three months’ notice of termination by the company.

The retirement age for executive directors is 65 years. A standard restraint of trade clause is incorporated into the employment contract for a maximum of three months without reward.

All exco members are employed on a full-time employment contract except for LM de Villiers and A Vitai, who are on fixed-term contracts expiring on 1 March 2018 and 1 March 2019 respectively.

External directorships

Executive directors are allowed to hold one external directorship in any company subject to prior board approval. All compensation earned from external directorships will accrue to Telkom. The board may decline external directorships as it may deem appropriate.

-

Section Two

Telkom’s share incentive plans are structured to optimise the company’s overall position, while providing benefits that will assist the company to attract, retain and incentivise executives and top talented employees.

The Performance Pays incentives vary between 0 percent and 12 percent based on individual performance and are payable per quarter. In addition, employees who perform at or above a three performance rating each year, will each receive a ‘14th cheque’, payable in June 2017.

Executive directors’ remuneration

Remuneration and benefits paid and STIs approved in respect of the 2017 financial year are set out in the following table.

Rand Guaranteed package STI* Fringe and

other benefitsLTI (vested shares) Total 2017 Total 2016 Executive directors SN Maseko 7 441 200 8 813 911 11 997 9 637 818 25 904 926 14 510 729 DJ Fredericks 5 250 000 4 365 753 11 997 3 857 167 13 484 917 9 456 765 Total 12 691 200 13 179 665 23 993 13 494 985 39 389 842 23 967 494 Prescribed officers’ remuneration (excluding executive directors)

The aggregate remuneration, benefits paid and STIs and LTIs approved for the 2017 financial year are set out in the following table. Executive and prescribed officers’ emoluments are set out in the financial statements in note 39.

2017 emoluments per prescribed officer

Company Remuneration*

RIncentive bonus

RFringe and

other benefits**

RLTI (vested shares)

RTotal

RPension -

TRF13%***

RmBC Armstrong 5 001 345 4 249 353 11 997 1 037 264 10 299 959 319 086 LM de Villiers 3 288 448 2 681 058 11 997 3 635 999 9 617 502 447 229 AN Samuels 4 500 000 4 433 738 11 997 - 8 945 735 339 300 IM Russell 4 153 353 4 103 244 11 997 1 236 249 9 504 843 323 961 J Henning 1 900 000 594 660 96 371 921 224 3 512 255 172 841 A Vitai 5 830 000 5 777 314 11 997 - 11 619 311 - NM Lekota2 266 667 179 207 - - 445 874 28 000 I Mophatlane 5 804 827 5 341 562 519 909 – 11 666 298 246 371 T Seopa 3 460 184 - - - 3 460 184 260 898 Total 34 204 823 27 360 137 676 265 6 830 736 69 071 961 2 137 686 2016 emoluments per prescribed officer

Company Remuneration*

RIncentive bonus

RFringe and

other

benefits**

RTotal

RPension - TRF13%***

RmBC Armstrong 5 001 345 3 340 323 481 830 8 823 498 455 122 LM de Villiers 3 288 448 2 051 514 321 557 5 661 519 447 229 TE Msubo3 1 383 071 - 317 475 1 700 546 107 880 GJ Rasethaba3 1 192 156 692 669 274 338 2 159 163 89 888 AN Samuels 4 291 667 3 489 288 350 649 8 131 604 524 667 V Scarcella3 1 430 000 1 011 458 329 038 2 770 496 111 540 IM Russell 4 153 353 3 000 011 402 977 7 556 341 323 961 MA Altman3 1 197 396 347 857 272 522 1 817 775 124 529 IC Coetzee 1 039 819 625 000 738 597 2 403 416 78 402 J Henning 4 1 295 455 1 091 071 11 997 2 398 523 - A Vitai4 2 650 000 1 911 922 11 997 4 573 919 - Total 26 922 710 17 561 113 3 512 977 2 263 218 Rand Guaranteed package Short-term

incentiveLong-term

incentiveFringe and

other benefitsTotal

FY2017Total

FY2016Executive management team 97 994 421 57 542 795 23 595 644 21 661 733 200 794 593 167 580 855 Number of employees 47 41 * Remuneration has been apportioned based on the period served as prescribed officers. Comparative information has been provided for members

identified as prescribed officers.

** Fringe and other benefits include motor car insurance and flexible allowance.

*** The pension contribution is a company contribution.

1 Stepped down following merger of enterprise with BCX.

2 Appointed to exco 1 March 2017.

3 Ceased to be prescribed officers on 31 August 2015.

4 Appointed to exco 19 October 2015.Non-executive directors’ fees

Non-executive directors’ remuneration key principles and policies

The board of directors, on the recommendation of Remco, determines the fees of the non-executive directors.

Fees for Telkom’s non-executive directors are determined by the board based on market practice, within the restrictions contained in Telkom’s MOI. Telkom’s non-executive directors receive no pay or benefits other than directors’ fees, with the exception of reimbursement of expenses incurred in connection with their directorships. The non-executive directors participate in neither the LTI share plan nor the STI plan outlined herein, and are not eligible for pension scheme membership.

The Remuneration structure is considered to be fair and reasonable and in the best interest of the company.

FY2017

RmFY2016

RmChair of the board 1 250 000 1 250 000 Non-executive director of the board 366 000 366 000 International board member 505 408 505 408 Audit committee chair 220 600 220 600 Audit committee member 134 900 134 900 Remuneration committee chair 200 000 200 000 Remuneration committee member 120 000 120 000 Nominations committee chair 133 050 133 050 Nominations committee member 90 000 90 000 Investment and transactions committee chair 138 138 138 138 Investment and transactions committee member 90 000 90 000 Social and ethics committee chair 200 000 200 000 Social and ethics committee member 120 000 120 000 Risk committee chair 200 000 200 000 Risk committee member 120 000 120 000 Refer to note 39 of the consolidated annual financial statements (available online) for fees paid to non-executive directors during the year.

Committee Scheduled meetings Fee per meeting Special meetings Fee per meeting Board 5 Annual retainer 2 Chairman:

R23 400

Board members:

R17 500Audit 6 Chairman: R55 150

Member: R33 7251 Risk 4 Chairman: R50 000

Member: R30 000- Remuneration 4 Chairman: R50 000

Member: R30 0001 Nominations 3 Chairman: R44 350

Member: R30 0002 Investment and transactions 4 Chairman: R46 046

Member: R30 0004 Social and ethics 4 Chairman: R50 000

Member: R30 000- Where any board member voluntarily attends a meeting of a committee of which he/she is not a member, there is no attendance fee payable. All fees are paid proportionally to the period in which office is held.

-

Beneficial shareholding

Directors’ shareholding as at 31 March 2017Directors' interest and prescribed officers Beneficial Non- beneficial Direct Indirect Direct Indirect Group and company

Number of shares

Directors' shareholding

2017

ExecutiveSN Maseko 52 520 - - - DJ Fredericks 48 711 267 - - Total 101 231 267 - - Non-executive JA Mabuza 26 000 - - - Kgaboesele 12 000 - - - KW Mzondeki 267 - - - F Petersen-Lurie Total 38 267 - - - The beneficial interest for one of our executive directors, DJ Fredericks, has increased from 9 607 to 48 711 in July 2016. In terms of the Telkom share plan and as disclosed in our FY2016 integrated report, 64 685 shares vested for DJ Fredericks and he disposed of 25 581 shares on 5 July 2016. The balance of 39 104 shares added to the 9 607 shares which he already held brought his total shares to 48 711.

There have been no changes in the above since 31 March 2017 to the date of approval of the consolidated annual financial statements.

Directors' interest and prescribed officers Beneficial Non- beneficial Direct Indirect Direct Indirect Group and company

Number of shares

Directors' shareholding

2017

ExecutiveSN Maseko 52 520 - - - DJ Fredericks 9 607 267 - - Total 62 127 267 - - Non-executive JA Mabuza 26 000 - - - F Petersen-Lurie - - - 400 I Kgaboesele 12 000 - - - KW Mzondeki 267 - - - Total 38 267 - - 400 In terms of the Telkom share plan 161 627 and 64 685 shares vested for SN Maseko and DJ Fredericks respectively. On 4 July 2016 SN Maseko disposed of 145 907 shares. On 5 July 2016, SN Maseko and DJ Fredericks disposed of 15 720 and 25 581 shares respectively.

-

Shares awarded

Year of the award Shares awarded Share award price

RFace value of award

RVested shares Vesting date Vesting price

RValue of vested shares

RClosing number SN Maseko FSP 2013 163 866 23.80 3 900 011 81 933 2016-06-06 59.63 4 885 665 81 933 ASA 2013 54 622 23.80 1 300 004 54 622 2016-06-06 59.63 3 257 110 - FSP 2014 138 352 76.11 10 529 971 - - - - 138 352 FSP 2015 150 428 74.20 11 161 758 - - - - 150 428 Performance shares 2015 50 143 74.20 3 720 611 25 072 2016-06-06 59.63 1 495 043 25 071 FSP 2016 197 066 56.64 11 161 818 - - - - 197 066 Performance shares 2016 65 689 56.64 3 720 625 - - - - 65 689 Total 820 166 45 494 798 161 627 9 637 818 658 539 DJ Fredericks FSP 2013 74 898 23.80 1 782 572 37 449 2016-06-06 59.63 2 233 084 37 449 ASA 2013 27 236 23.80 648 217 27 236 2016-06-06 59.63 1 624 083 – FSP 2014 86 705 76.11 6 599 118 - - - - 86 705 FSP 2015 53 066 74.20 3 937 497 - - - - 53 066 FSP 2016 69 043 57.03 3 937 522 - - - - 69 043 Total 310 948 16 904 926 64 685 3 857 167 246 263 BC Armstrong FSP 2013 15 126 23.80 359 999 7 563 2016-06-06 59.63 450 982 7 563 ASA 2013 9 832 23.80 234 002 9 832 2016-06-06 59.63 586 282 - FSP 2014 82 717 76.11 6 295 591 - - - - 82 717 FSP 2015 50 553 74.20 3 751 033 - - - - 50 553 FSP 2016 65 773 - 3 751 034 - - - - 65 773 Total 224 001 14 391 658 17 395 1 037 264 206 606 LM de Villiers FSP 2013 70 603 23.80 1 680 351 35 302 2016-06-06 59.63 2 105 058 35 301 ASA 2013 25 674 23.80 611 041 25 674 2016-06-06 59.63 1 530 941 - FSP 2014 54 569 76.11 4 153 247 - - - - 54 569 FSP 2015 33 239 74.20 2 466 334 - - - - 33 239 FSP 2016 43 246 57.03 2 466 319 - - - - 43 246 Total 227 331 11 377 292 60 976 3 635 999 166 355 AN Samuels FSP 2014 55 629 76.11 4 233 923 - - - - 55 629 FSP 2015 40 431 74.20 2 999 980 - - - - 40 431 FSP 2016 59 179 57.03 3 374 978 - - - - 59 179 Total 155 239 10 608 882 155 239 IM Russell FSP 2013 24 005 30.35 728 552 12 003 2016-06-06 59.63 715 739 12 002 ASA 2013 8 729 30.35 264 925 8 729 2016-06-06 59.63 520 510 - FSP 2014 68 922 76.11 5 245 653 - - - - 68 922 FSP 2015 41 981 74.20 3 114 990 - - - - 41 981 FSP 2016 54 621 57.03 3 115 036 - - - - 54 621 Total 198 258 12 469 156 20 732 1 236 249 177 526 A Vitai FSP - - - - - - - - - ASA - - - - - - - - - FSP 2014 95 374 76.11 7 258 915 - - - - 95 374 FSP 2015 58 929 74.20 4 372 532 - - - - 58 929 FSP 2016 76 670 57.03 4 372 490 - - - - 76 670 Total 230 973 16 003 937 230 973 J Henning FSP 2013 30 897 23.80 735 349 15 449 2016-06-06 59.63 921 224 15 448 ASA 2013 - - - - 2016-06-06 - - - FSP 2014 23 680 76.11 1 802 285 - - - - 23 680 FSP 2015 13 443 74.20 997 471 - - - - 13 443 FSP 2016 17 491 57.03 997 512 - - - - 17 491 Total 85 511 4 532 616 15 449 921 224 70 062 NM Lekota FSP 2016 21 042 57.03 1 200 025 - - - - 21 042 Total 21 042 1 200 025 - 21 042 LI Mophatlane FSP 2016 255 384 65.34 16 686 791 - - - - 255 384 Total 255 384 16 686 791 - 255 384 TS Seopa FSP 2016 147 805 70.23 10 380 552 - - - - 147 805 Total 147 805 10 380 552 - 147 805